FREQUENTLY ASKED QUESTIONS ON ENTITLEMENT RULES 2023 AND GMO 2023 … [Read more...] about FAQ ON ENTITLEMENT RULES 2023 AND GUIDE TO MEDICAL OFFICERS 2023

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

FAQ

FAQ EMPANELMENT OF ADVOCATES FOR UNION OF INDIA

FREQUENTLY ASKED QUESTIONS ON EMPANELMENT OF ADVOCATES FOR UNION OF INDIA FAQ Q.1 What is ‘Panel Counsel’ for Union of India? Department of Legal Affairs has been mandated with conduct of litigations on behalf of Union of India before various courts / tribunals in India. For this purpose, Department of Legal Affairs empanels Advocates for various courts / tribunals … [Read more...] about FAQ EMPANELMENT OF ADVOCATES FOR UNION OF INDIA

Leave applicable to Railway employees FAQ

Leave for a railway servant - FAQ भारत सरकार/ GOVERNMENT OF INDIAरेल मंत्रालय/ MINISTRY OF RAILWAYS(रेलवे बोर्ड/ RAILWAY BOARD) RBE No.163/2022 No. E(P&A)I-2008 /CPC/LE-8 New Delhi dated 19.12.2022 The General Managers/PFAs,All Indian Railways andProduction Units. Sub: Leave applicable to Railway employees - Frequently Asked Questions (FAQ). Please … [Read more...] about Leave applicable to Railway employees FAQ

FAQ Child Care Leave CCL – Female railway employees

Child Care Leave – Frequently Asked Questions (FAQs) Sl. No.QuestionClarificationRBE Authority No.Serial Circular No.1.Who among the employees may be granted CCL by an authority competent to grant leave ?.Female railway employees.158/2008132/082.From which date this facility is available ?From 01.09.2008158/2008132/083.What is the purpose of CCL ?Purpose of CCL is taking … [Read more...] about FAQ Child Care Leave CCL – Female railway employees

Revised FAQ on CGGPRA Rules Eligibility and Entitlements PDF

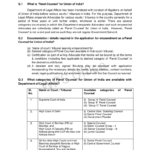

FAQ Central Government General Pool Residential Accommodation CGGPRA or Government residential accommodation GRA FREQUENTLY ASKED QUESTIONS I. ELIGIBILITY AND ENTITLEMENTS What is General Pool Residential Accommodation or Government residential accommodation [GRA].General Pool Residential Accommodation [GPRA] means Central Government residential accommodations under … [Read more...] about Revised FAQ on CGGPRA Rules Eligibility and Entitlements PDF

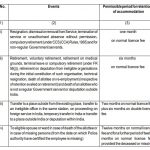

Important FAQ regarding Bonus for Central Government Employees and regulation of Ad-hoc/Non-PLB Bonus – FinMin Order

Central Government Employees Bonus 2020 30 days bonus for Central Government Employees -Non-Productivity Linked Bonus (ad-hoc bonus) for the year 2019-2020 – FinMin Order FAQ regarding regulation of Ad-hoc/ Non-PLB Bonus Employees appointed on purely temporary ad-hoc basis?Yes, if there is no break in serviceEmployees who resigned, retired from service or expired … [Read more...] about Important FAQ regarding Bonus for Central Government Employees and regulation of Ad-hoc/Non-PLB Bonus – FinMin Order

DoPT – FAQ on Scheme of Adventure Sports Programmes : Point of Doubts and Clarification

Latest DoPT News Frequently Asked Questions on Scheme of Adventure Sports Programmes : Sl No.Point of DoubtsClarification 1Who all are responsible for conducting the Scheme ?The scheme is conducted by Central Civil Services Cultural and Sports Board, a Society registered under the Society Registration Act, 1860, which functions under the aegis of Department of … [Read more...] about DoPT – FAQ on Scheme of Adventure Sports Programmes : Point of Doubts and Clarification

Joining Time Rules – Central Government Employees who join an another Government organization – FAQ

Joining Time Rules - Central Government Employees who join an another Government organization - FAQ Joining Time Rules S.NoFAQAnswer1Whether Joining time ffloining Time pay is admissible in case of technical resignation of a Government servant to join another Government organization.For appointment to posts under the Central Government on the results of a competitive … [Read more...] about Joining Time Rules – Central Government Employees who join an another Government organization – FAQ

FAQ for Scheme Preference under NPS for Central Government Subscribers

Frequently Asked Questions (FAQs) for Scheme Preference under NPS for Central Government Subscribers Is the choice of Pension Fund and Investment Pattern available for Subscriber under Tier I? As per Ministry of Finance Gazette Notification dated January 31, 2019, the Central Government Subscribers, from April 1, 2019, will have the option of selecting the Pension Funds … [Read more...] about FAQ for Scheme Preference under NPS for Central Government Subscribers

FAQ on reservations for disabled persons in Central Government posts / services

FAQ on reservations for disabled persons in Central Government posts / services No.36035/02/2017-Estt (Res) Government of India Ministry of Personnel, Public Grievances & Pensions Department of Personnel & Training North Block, New Delhi dated the 25 March, 2019 Subject: Frequently Asked Questions (FAQs) on reservation to Persons with Benchmark Disabilities in … [Read more...] about FAQ on reservations for disabled persons in Central Government posts / services

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF