OROP latest News today Armed Forces Personnel retired up to June 30, 2019 to be covered; Over 25.13 lakh to be benefitted Rs 23,638 crore to be paid as arrears from July 2019 to June 2022 Estimated additional annual expenditure for implementation of the revision calculated as approx. Rs 8,450 crore @31% Dearness Relief Posted On: 23 DEC 2022 The Union Cabinet, … [Read more...] about OROP – Union Cabinet approves revision of pension of Armed Forces Pensioners/ family pensioners w.e.f. 1st July 2019

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Family Pensioners

NRI pensioners/ family pensioners have to submit their life certificate for current year through following way/method as per Proforma No. 5

Life Certificate by NRI Pensioners O/o THE PRINCIPAL CONTROLLER OF DEFENCE ACCOUNTS (PENSIONS)DRAUPADI GUAT, PRAYAGRAS 211014 Important instructions for submission of Life Certificate by NRI Pensioners living abroad on SPARSH NRI pensioners/ family pensioners have to submit their life certificate for current year through following way/ method as per Proforma No. 5 of … [Read more...] about NRI pensioners/ family pensioners have to submit their life certificate for current year through following way/method as per Proforma No. 5

6th Punjab Pay Commission for Chandigarh Administration Revision of Pay Scales

6th Punjab Pay Commission Revision of Pay Scales in pursuance of the recommendation of 6th Punjab Pay Commission for Chandigarh Administration: CPAO OM dated 06.09.2022 GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF EXPENDITURECENTRAL PENSION ACCOUNTING OFFICETRIKOOT-II, BHIKAJI CAMA PLACE,NEW DELHI - 110066 CPAO/ IT & Tech/ UT Chandigarh /50/ 6476/ … [Read more...] about 6th Punjab Pay Commission for Chandigarh Administration Revision of Pay Scales

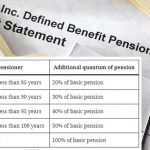

Additional quantum of pension on attaining the age of 65 years, 70 years and 75 years under the CCS Pension Rules

Additional quantum of Pension to the Pensioners Most Immediate/Parliament Matterफा.न. of. 38/02(01/2022-P&PW(A) (7691)भारत सरकार Government of Indiaकार्मिक, लोक शिकायत और पेंशन मंत्रालय Ministry of Personnel, PG & Pensionsपेंशन और पेंशनभोगी कल्याण विभाग Department of Pension & Pensioners’ Welfareलोक नायक भवन 3rd Floor, Lok Nayak Bhawanखान मार्केट नई दिल्ली … [Read more...] about Additional quantum of pension on attaining the age of 65 years, 70 years and 75 years under the CCS Pension Rules

Speedy disposal of pensions grievances, especially lodged by Family Pensioners and Super Senior Pensioners 80 years & above age

Super Senior Pensioners CGDA Controller General of Defence Accounts,Ulan Batar Road, Palam, Delhi Cantt.- 110010Phone: 011-25665581, 25665562, 25665745Fax: 011-25674806, 25674821email: grievancecgda [dot] dad [at] gov [dot] in F No. AN/ Grievance/ Report meeting/ Vol VIII Dated: 23/09/2021 ToAll PCsSDA/PCA(Fys)/PIFASCsDAICFAS/NADFM/RTCs/IFAS Subject: Speedy … [Read more...] about Speedy disposal of pensions grievances, especially lodged by Family Pensioners and Super Senior Pensioners 80 years & above age

Submission of Annual Life Certificate for NRI Pensioners/Family Pensioners

Submission of Annual Life Certificate for pensioners/family pensioners living abroad No. 1(8)/2021-P&PW(H)-7468Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Pension and Pensioners’ Welfare 8th Floor, B-Wing,Janpath Bhawan, Janpath,New Delhi-110001Dated:- 22nd September, 2021 OFFICE MEMORANDUM Subject: Submission of … [Read more...] about Submission of Annual Life Certificate for NRI Pensioners/Family Pensioners

Grant of Dearness Allowance to West Bengal State Government Employees and also Dearness Relief to the Pensioners Family Pensioners

DA to West Bengal State Government Employees GOVERNMENT OF WEST BENGALFINANCE (AUDIT) DEPARTMENTNABANNA, MANDIRTALA, HOWRAH-711 102 No. 3490-F(P2) Dated, Howrah, the 14th December, 2020. MEMORANDUM Subject: Grant of Dearness Allowance to State Government Employees and the employees of Government aided Educational Institutions, employees of Statutory Bodies, … [Read more...] about Grant of Dearness Allowance to West Bengal State Government Employees and also Dearness Relief to the Pensioners Family Pensioners

Defence Pension – Implement of OROP to Defence Forces Pensioners / Family Pensioners – PIB News

OROP - Defence Pension Ministry of Defence Five years of historic decision to implement OROP; Over Rs. 42740 Crore disbursed to 20,60,220 Defence Forces Pensioners / Family Pensioners 06 NOV 2020 Government of India took the historic decision to implement One Rank One Pension, OROP by issuing an order on 7.11.2015, benefit effective from 01.07.2014, despite huge … [Read more...] about Defence Pension – Implement of OROP to Defence Forces Pensioners / Family Pensioners – PIB News

Request for Festival grant or Advance to all the Central government Pensioners and Family Pensioners

Festival Advance to all Pensioners NATIONAL COORDINATION COMMITTEEOF PENSIONERS ASSOCIATIONS.13-C Feroze Shah Road,New Delhi.110 001 Dated: 24/10/2020 ToMs. Nirmala SeetharamanHon’ble Finance Minister,Govt. of India, North Block,New Delhi. 110 001. Dear Madam, Sub: Request for festival grant or advance. As you are aware the Pandemic Covid 19 is spreading … [Read more...] about Request for Festival grant or Advance to all the Central government Pensioners and Family Pensioners

Consolidated guidelines for pension disbursement authorities to ensure that pensioners / family pensioners are collected smoothly

Paying additional amount of pension on attaining the age of 80 ears and above - Pension - Pensioners - Family Pension No.12/4/2020-P&PW(C)-6300Government of IndiaMinistry of Personnel, Public Grievances & PensionDepartment of Pension & Pensioners’ Welfare 8th Floor, Janpath Bhavan,Janpath, New Delhi,Dated: 15th May, 2020 OFFICE MEMORANDUM Subject : … [Read more...] about Consolidated guidelines for pension disbursement authorities to ensure that pensioners / family pensioners are collected smoothly

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF