CSD through e-Platform for Ex-Servicemen GOVERNMENT OF INDIAMINISTRY OF DEFENCEDEPARTMENT OF DEFENCERAJYA SABHAUNSTARRED QUESTION NO. 379TO BE ANSWERED ON 24th July, 2023 CSD THROUGH E-PLATFORM FOR EX-SERVICEMEN 379. SHRI AJAY PRATAP SINGH:Will the Minister of Defence be pleased to state: (a) whether Government is going to create an e-platform like Amazon, … [Read more...] about Government is going to create an e-platform like Amazon, Flipkart etc., to provide CSD canteen and other facilities to the ex-servicemen

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Ex-Servicemen

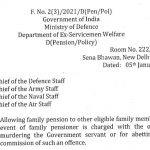

Allowing family pension to other eligible family member in the event of family pensioner is charged with the offence of murdering the Government servant or for abetting in the commission of such an offence

Ex-Servicemen : Family pensioner is charged with the offence of murdering the Government servant or abetting - Suspension of family pension F. No. 2(3)/2021/D (Pen/Pol)Government of IndiaMinistry of DefenceDepartment of Ex-Servicemen WelfareD (Pension/Policy) Room No. 222, ‘B’ Wing,Sena Bhawan, New Delhi-110011.Dated: 05th January, 2022 ToThe Chief of the Defence … [Read more...] about Allowing family pension to other eligible family member in the event of family pensioner is charged with the offence of murdering the Government servant or for abetting in the commission of such an offence

Nomination of Liaison Officer for implementation of orders of reservations relating to Ex-Servicemen in the posts and services of the Central Government

Nomination of Liaison Officer - The particulars and contact details of liaison officer, so appointed, may be intimated to the Department of Ex-servicemen Welfare. Latest DoPT Orders 2022 No. 36034/2/2017-Estt.(Res.)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment ol’Personnel and Training North Block, New DelhiDated the 31ˢᵗ … [Read more...] about Nomination of Liaison Officer for implementation of orders of reservations relating to Ex-Servicemen in the posts and services of the Central Government

15th Finance Commission Report defence pension, mulling separate NPS for armed forces, increasing the retirement age of POBR

15th Finance Commission Report As per 15th Finance Commission Report, the MoD has been examining various possibilities of reforms in defence pension, as deliberated by relevant Parliamentary Committee. The extract of Para 11.66 is reproduced below:- 11.66 The MoD has been examining various possibilities of reforms in defence pension, as deliberated by relevant … [Read more...] about 15th Finance Commission Report defence pension, mulling separate NPS for armed forces, increasing the retirement age of POBR

Reimbursement of one pulse oximeter per family allowed under ECHS to fight COVID-19

Reimbursement of one pulse oximeter per family allowed under ECHS to fight COVID-19 Ministry of DefencePress Information BureauGovernment of India Dated: 08 JUL 2020 As measuring of oxygen saturation level is one of the most important parameters for monitoring the health of COVID-19 patients, Ministry of Defence (MoD), Department of Ex-Servicemen Welfare (DSEW) has … [Read more...] about Reimbursement of one pulse oximeter per family allowed under ECHS to fight COVID-19

Initial pay fixation of re-employed ex-servicemen who held roles below the Commissioned Officer Level in Defence Forces, retired before reaching the age of 55 and re-employed in civilian posts in Railways etc.,

NFIR Granting pay re-fixation to former Defence Forces personnel ex-servicemen re-employed in the Central Government Orgarnzations / Departments, are issued, taking into consideration the last pay drawn in Defence Forces at the time of retirement. No.II/35/2019 Dated: 14/03/2020 The Cabinet Secretary, Rashtrapati Bhavan, New Delhi - 110004 Dear Sir, Sub: … [Read more...] about Initial pay fixation of re-employed ex-servicemen who held roles below the Commissioned Officer Level in Defence Forces, retired before reaching the age of 55 and re-employed in civilian posts in Railways etc.,

State-wise details of ex-servicemen trained/oriented under PMKVY 2016-2020

State-wise details of ex-servicemen trained/oriented under PMKVY 2016-2020 Enrolling of Ex-Servicemen under Pradhan Mantri Kaushal Vikas Yojana (PMKVY) Under Pradhan Mantri Kaushal Vikas Yojana (PMKVY) skilling is being imparted through Short Term Training (STT) courses and Recognition of Prior Learning (RPL). STT is being imparted to either school/college dropouts or … [Read more...] about State-wise details of ex-servicemen trained/oriented under PMKVY 2016-2020

Fixation of pay on re-employment of ex-servicemen by Hon’ble CAT Bangalore Bench Judgment

Fixation of pay on re-employment of ex-servicemen by Hon’ble CAT Bangalore Bench Judgment The applicant, an ex-serviceman was appointed as postal assistant in initial pay Rs 9910 + Grade Pay Rs. 2400 in 05.04.2011… F.No.01-02/2018-PAP Department of Posts (Establishment Division/ P.A.P. Section) Dak Bhawan, Sansad Marg, New Delhi-110001 Dated: 17/09/2019 All Heads of … [Read more...] about Fixation of pay on re-employment of ex-servicemen by Hon’ble CAT Bangalore Bench Judgment

One time contribution for ECHS membership and entitlement of ward in empanelled hospitals / medical facilities in respect of World War-II Veterans, SSCOs, ECOs and Pre-mature Retirees

No.17(11)/2018/WE/D(Res-I) GOVERNMENT OF INDIA MINISTRY OF DEFENCE (DEPARTMENT OF EX-SERVICEMEN WELFARE) B WING, ROOM No.221 SENA BHAVAN, NEW DELHI Dated 12th April, 2019 The Chief of Army Staff The Chief of Naval Staff The Chief of Air Staff Subject : One time contribution for ECHS membership and entitlement of Ward in empanelled Hospitals/ Medical facilities in … [Read more...] about One time contribution for ECHS membership and entitlement of ward in empanelled hospitals / medical facilities in respect of World War-II Veterans, SSCOs, ECOs and Pre-mature Retirees

PIB: Cabinet approves grant of medical facilities under Ex-Servicemen Contributory Health Scheme (ECHS)

Cabinet Cabinet approves grant of medical facilities under Ex-Servicemen Contributory Health Scheme (ECHS) to World War-II Veterans, Emergency Commissioned Officers (ECOs), Short Service Commissioned Officers (SSCOs) and pre-mature retirees More than 40,000 individual to be benefitted 07 MAR 2019 The Cabinet Meeting Chaired by Prime Minister Narendra Modi today … [Read more...] about PIB: Cabinet approves grant of medical facilities under Ex-Servicemen Contributory Health Scheme (ECHS)

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF