Benefit of CGEGIS on Re-Classification of posts according to Grade Pay of Master Craftsman: BPMS writes to DGQA Bharatiya Pratiraksha Mazdoor Sangh(AN ALL INDIA FEDERATION OF DEFENCE WORKERS)(AN INDUSTRIAL UNIT OF B.M.S.)(RECOGNISED BY MINISTRY OF DEFENCE, GOVT. OF INDIA)CENTRAL OFFICE : 2-A, NAVIN MARKET, KANPUR-1 REF: BPMS / DGQA / CGEGIS / 71 (7/3/R) Dated: … [Read more...] about Benefit of Central Government Employees Group Insurance Scheme on Re-Classification of posts according to Grade Pay of Master Craftsman BPMS

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

CGEGIS

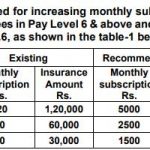

Central Government Employees Group insurance Scheme CGEGIS Revision of coverage & monthly subscription – IRTSA

7th CPC Central Government Employees Group Insurance scheme INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION Indian railway latest news today No: IRTSA/ CHQ/ CGEGIS/2022-2 Date: 23.04.2022 Secretary Finance (Expenditure),North Block,New Delhi - 110001 Respected Sir, Sub: Central Government Employees Group insurance Scheme (CGEGIS) - Revision of coverage … [Read more...] about Central Government Employees Group insurance Scheme CGEGIS Revision of coverage & monthly subscription – IRTSA

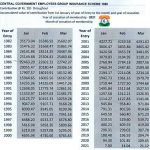

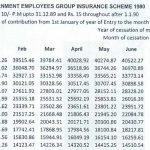

Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund for the period from January 2021 to March 2021

CGEGIS 1980 Table of Benefits from January 2021 to March 2021 Central Government Employees Group Insurance Scheme-1980 - Tables of Benefits for the savings fund for the period from 01.01.2021 to 31.03.2021 No.7(2)/EV/2016Government of IndiaMinistry of FinanceDepartment of Expenditure New Delhi, the 15th February, 2021 OFFICE MEMORANDUM Sub: Central Government … [Read more...] about Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund for the period from January 2021 to March 2021

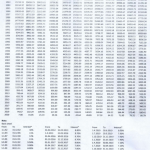

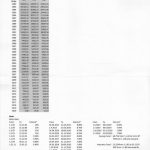

Central Government Employees Group Insurance Scheme-1980 – Tables of Benefits for the savings fund for the period from 01.10.2020 to 31.12.2020

Central Government Employees Group Insurance Scheme No. 7(2)/ EN / 2016Government of IndiaMinistry of FinanceDepartment of Expenditure New Delhi, the 27 November, 2020 OFFICE MEMORANDUM Sub: Central Government Employees Group Insurance Scheme-1980 - Tables of Benefits for the savings fund for the period from 01.10.2020 to 31.12.2020. The Tables of Benefits for … [Read more...] about Central Government Employees Group Insurance Scheme-1980 – Tables of Benefits for the savings fund for the period from 01.10.2020 to 31.12.2020

Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund for the period from 1st July to 30th September, 2020

Central Government Employees Group Insurance Scheme No. 7(2)/EV/2016Government of IndiaMinistry of FinanceDepartment of Expenditure New Delhi, the 19th August, 2020 OFFICE MEMORANDUM Sub : Central Government Employees Group Insurance Scheme-1980 - Tables of Benefits for the savings fund for the period from 01.07.2020 to 30.09.2020. The Tables of Benefits for … [Read more...] about Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund for the period from 1st July to 30th September, 2020

CGEGIS 1980 – Table of Benefits for the savings fund for the period from 01.04.2020 to 30.06.2020

CGEGIS 1980 F.No.28-01/2018-PAPGovernment of IndiaMinistry of CommunicationsDepartment of Posts[Establishment Division/P.A.P. Section] Dak Bhawan, Sansad Marg,New Delhi-110001Dated: 15th July, 2020. To All Chief Postmasters General/ Postmasters GeneralChief General Manager, BD Directorate/Parcel Directorate/ PLI DirectorateDirector RAKNPA/ GM CEPT) Directors of All … [Read more...] about CGEGIS 1980 – Table of Benefits for the savings fund for the period from 01.04.2020 to 30.06.2020

Revision of Central Government Employees Group Insurance Scheme (CGEGIS) June 18, 2020

Central Government Employees Group Insurance Scheme (CGEGIS) No.NC/JCM/2020 Date: June 18, 2020 The Secretary,Department of Personnel & Training,(Government of India),North Block, New Delhi-110001 Dear Sir, Sub: Central Government Employees Group Insurance Scheme (CGEGIS) Ref.: (i) Customized CGEGIS, Dept. of Expenditure, MoF’s OM dated 07.12.2018(ii) … [Read more...] about Revision of Central Government Employees Group Insurance Scheme (CGEGIS) June 18, 2020

Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 1st April 2020 to 30th June 2020

Central Government Employees Group Insurance Scheme 1980 - Tables of Benefits for the savings fund from 1st April 2020 to 30th June 2020 CGEGIS 2020 No.7(2)/EV/2016Government of IndiaMinistry of FinanceDepartment of Expenditure New Delhi, the 20th May, 2020 OFFICE MEMORANDUM Sub : Central Government Employees Group Insurance Scheme-1980 – Tables of Benefits for … [Read more...] about Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 1st April 2020 to 30th June 2020

Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 1st Jan 2020 to 31st March 2020

CGEGIS 2020 Central Government Employees Group Insurance Scheme CGEGIS 1980 - Tables of Benefits for the savings fund from 1st Jan 2020 to 31st March 2020 No. 7(2)/EV/2016 Government of India Ministry of Finance Department of Expenditure New Delhi, the 5th February, 2020 OFFICE MEMORANDUM Sub: Central Government Employees Group Insurance Scheme 1980 - Tables of … [Read more...] about Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 1st Jan 2020 to 31st March 2020

Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 01.10.2019 to 31.12.2019

CGEGIS 2019 No.7(2)/ EV/ 2016 Government of India Ministry of Finance Department of Expenditure New Delhi, the 11th December, 2019 OFFICE MEMORANDUM Subject: Central Government Employees Group Insurance Scheme-1980 - Tables of Benefits for the savings fund for the period from 01.10.2019 to 31.12.2019. The Tables of Benefits for Savings Fund to the beneficiaries … [Read more...] about Central Government Employees Group Insurance Scheme 1980 – Tables of Benefits for the savings fund from 01.10.2019 to 31.12.2019

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF