KVS Teaching staff The Deputy Commissioner/ DirectorKendriya Vidyalaya SangathanAll Regional Offices/ ZIETs/ KVS (HQ) Subject: Modified Assured Career Progression Scheme in respect of Group 'A' and 'B' Officers having initial Grade Pay of Rs.4600/- (Level-7) and above at par with Central Government Civilian Employees - Regarding. Madam/Sir Govt. of India, vide … [Read more...] about MACP Scheme in respect of Group A and B officers having initial Grade pay 4600 (Level- 7) and above at par with Central Government Civilian Employees

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

CENTRAL GOVERNMENT CIVILIAN EMPLOYEES

Methodology for fixation of basic pay in cases of ACP and regular promotion under 6th Central Pay Commission

Fixation of basic pay on promotion GOVERNMENT OF INDIAMINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(DEPARTMENT OF PERSONNEL AND TRAINING) RAJYA SABHA UNSTARRED QUESTION NO. 427(TO BE ANSWERED ON 04.02.2021) METHODOLOGY FOR FIXATION OF BASIC PAY 427 SHRI NEERAJ SHEKHAR: Will the PRIME MINISTER be pleased to state: (a) whether there is any … [Read more...] about Methodology for fixation of basic pay in cases of ACP and regular promotion under 6th Central Pay Commission

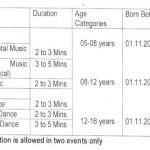

DoPT Orders 2020: Online Music and Dance Competition for wards of Central Government Employees

Latest DoPT Orders 2020 Central Civil Services Cultural & Sports Board(Registration No. 2621)Department of Personnel & TrainingMinistry of Personnel, Public Grievances and PensionsGovernment of India 361, B-Wing, 3rd FloorLok Nayak Bhawan New Delhi - 110 003 No. 18/03/2018-19/ CCSCSB Dated:21.10.2020 Το,The Secretaries of All Regional Sports BoardsThe … [Read more...] about DoPT Orders 2020: Online Music and Dance Competition for wards of Central Government Employees

GRANT OF 2nd FIANANCIAL UPGRADATION UNDER ACP SCHEME WHO HAVE COMPLETED 24 YEARS REGULAR SERVICE

MACP FOR THE CENTRAL GOVERNMENT CIVILIAN EMPLOYEES ACP SCHEME Tele : 23014594Dte Gen of PersonnelMilitary Engineer ServicesEngineer-in-Chiefs BranchKashmir House, Rajaji MargNew Delhi - 110011. PC-4/85610/47/MACP/’ D’ Man /GANGADHARAN/CSCC OF Dated: 08 sep 2020 ADG (D&C) Range Hills Rd, Kirkee Pune-411003ADG(Coast Guard & Projects) Chennai-600009ADG(NEI) … [Read more...] about GRANT OF 2nd FIANANCIAL UPGRADATION UNDER ACP SCHEME WHO HAVE COMPLETED 24 YEARS REGULAR SERVICE

Scheme for promotion of Adventure Sports and Similar Activities amongst Central Government Civilian Employees – Latest DoPT Orders 2020

Scheme for promotion of Adventure Sports and Similar Activities amongst Central Government Civilian Employees - Latest DoPT Orders 2020 No.1251/2019.20 - CCSCSB Government of India Ministry of Personnel, Public Grievances & Pensions (Department of Personnel & Training) Latest DoPT Orders 2020 CIRCULAR Date 16.01.2020 Sub: Scheme for promotion of … [Read more...] about Scheme for promotion of Adventure Sports and Similar Activities amongst Central Government Civilian Employees – Latest DoPT Orders 2020

Rules for Central Government Employees to Contests Elections

Ministry of Personnel, Public Grievances & Pensions Rules for Government Employees to Contests Elections 04 DEC 2019 The Central Civil Services (Conduct) Rules, 1964, which are applicable to the Central Government civilian employees, prohibit the employees from contesting elections to any Legislative or Local Authority. The conduct of employees of autonomous … [Read more...] about Rules for Central Government Employees to Contests Elections

DoPT: Scheme for Promotion of Adventure Sports & Similar Activities amongst Central Government Civilian Employees

DoPT: Scheme for Promotion of Adventure Sports & Similar Activities amongst Central Government Civilian Employees No.125/1/2018-19-CCSCSB Government of India Ministry of Personnel, Public Grievances & Pensions (Department of Personnel & Training) Dated:04.02.2019 CIRCULAR Sub: Scheme for Promotion of Adventure Sports & Similar Activities amongst Central … [Read more...] about DoPT: Scheme for Promotion of Adventure Sports & Similar Activities amongst Central Government Civilian Employees

CGGPRA: Clarification regarding the term ‘Non-Family Station’ in respect of concessional retention of Government Accommodation

CGGPRA: Clarification regarding the term 'Non-Family Station' in respect of concessional retention of Government Accommodation F.No.12035/4/2015-Poll.II Government of India Ministry of Housing and Urban Affairs Directorate of Estates Policy-II Section Nirman Bhavan, New Delhi -110 108 Dated the 1st August, 2018 Office Memorandum Subject: Clarification regarding the … [Read more...] about CGGPRA: Clarification regarding the term ‘Non-Family Station’ in respect of concessional retention of Government Accommodation

Grant of financial upgradation under ACP & MACP Schemes for the Central Government Civilian Employees including Railway employees

NFIR Grant of financial upgradation under ACP & MACP schemes for the central Government Civilian Employees including Railway employees No. IV/MACPs/09/part II Dated: 21/08/2018 The Secretary / DoP&T (Department of personnel PG & pension), Department of personnel & Training, North Block, New Delhi. Dear Sir, Sub: Grant of financial upgradation … [Read more...] about Grant of financial upgradation under ACP & MACP Schemes for the Central Government Civilian Employees including Railway employees

Shortage of manpower in Central Government offices

Shortage of manpower in Central Government offices The number of sanctioned posts and number in position in various Ministries/Departments as available in the Annual Report on Pay and Allowances of Central Government Civilian Employees 2016-17 as on 1.3.2016, published by Pay Research Unit, Department of Expenditure, Ministry of Finance, is at Annexure 'A'. The posts … [Read more...] about Shortage of manpower in Central Government offices

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF