BSNL wage revision (A GOVERNMENT OF INDIA ENTERPRISE)O/o Sr. GM(SR), Corporate Office8th Floor, Bharat Sanchar Bhawan,Harish Chander Mathur Lane, No.BSNL/38-1/SR/2016 Dated: 07.03.2022 Subject: Record of discussion of the reconstituted Joint committee for recommending wage revision for non-executive employees w.e.f 01.01.2017 in BSNL held on 03.12.2021. The … [Read more...] about BSNL wage revision for non-executive employees w.e.f 01.01.2017 held on 03.12.2021

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

BSNL

CPSEs Revision of pay scales – BSNL IDA rates from July 2021

BSNL IDA rates from July 2021 BHARAT SANCHAR NIGAM LIMITEDCORPORATE OFFICE(A Government of India Enterprise)Establishment Branch F.No: BSNLCO-A/11(18)/1/2020-ESTAB Dated: 05th August, 2021 OFFICE MEMORANDUM Subject: Board level & below Board level posts including Non-unionized supervisors in Central Public Sector Enterprises (CPSEs) - Revision of scales of … [Read more...] about CPSEs Revision of pay scales – BSNL IDA rates from July 2021

Release of terminal benefits to employees’ families who died as a result of COVID-19 infection or other causes: Order from BSNL

Release of terminal benefits to the family of employees, who died due to COVID-19 infection or other reasons: BSNL Order BHARAT SANCHAR NIGAM LIMITED(A Government of India Enterprise) CORPORATE OFFICEEstablishment CellBharat Sanchar BhawanH.C. Mathur Lane,New Delhi- 01 Dated: 13 May, 2021 To.All Heads of Telecom Circles &All Heads of Other Administrative … [Read more...] about Release of terminal benefits to employees’ families who died as a result of COVID-19 infection or other causes: Order from BSNL

In light of the Covid-19 epidemic, BSNLMRS has issued guidelines.

Guidelines under BSNLMRS in view of Covid-19 pandemic: BSNL BHARAT SANCHAR NIGAM LIMITEDCorporate OfficeAdmin & PR Branch1st Floor, Bharat Sanchar Bhawan,H.C.Mathur Lane, Janpath,New Delhi-110001 No BSNLCO-ADMN/11(15)/2/2021-ADMN Dated 3rd May 2021 To, All the CGMs/Unit Heads,BSNL Sub : Guidelines under BSNLMRS in view of Covid-19 pandemic In order to … [Read more...] about In light of the Covid-19 epidemic, BSNLMRS has issued guidelines.

Special concessions to Central Government Employees working in Kashmir Valley in attached/subordinate offices or PSUs falling under the control of Central Govt.

Central Govt Employees working in Kashmir Valley BSNL BHARAT SANCHAR NIGAM LIMITED(A Govt. of India Enterprise) F.No. BSNLCO-A /14(21/1/2021-ESTAB Dated: 15 /03/2021 ToThe Chief General Manager,BSNL, J&K Telecom Circle,Jammu. Sub:- Special concessions to Central Govt. Employees working in Kashmir Valley in attached/subordinate offices or PSUs falling under … [Read more...] about Special concessions to Central Government Employees working in Kashmir Valley in attached/subordinate offices or PSUs falling under the control of Central Govt.

Grant of annual increment falling due on the next day of superannuation/ retirement, for the purpose of pensionary benefits

Annual increment next day of superannuation BSNL BHARAT SANCHAR NIGAM LIMITED[A Government of India Enterprise]Corporate Office, Taxation Section First Floor, Bharat Sanchar BhawanJanpath, NewDelhi-110 002Dated: 18.02.2020 No.48-2 / 2021-Pen (B) To All Heads of Circles/ Telecom Districts/ Regions/ Projects/Telecom Stores /Telecom Factories & Other … [Read more...] about Grant of annual increment falling due on the next day of superannuation/ retirement, for the purpose of pensionary benefits

Recovery of dues other than Government dues from the retirement benefits of BSNL VRS-2019 Scheme retired employees

Retirement benefits of BSNL VRS-2019 Scheme BHARAT SANCHAR NIGAM LIMITED(A Govt. of India Enterprise)Corporate OfficePension Section, 5th floor Bharat Sanchar BhawanH.C. Mathur Lane, New Delhi-110001 No.48-2/2020- Pen (B) Dated: 20-01-2021 ToAll Heads of Circles/ Telecom Districts/ Regions/ Projects/Telecom Stores/ Telecom Factories & Other Administrative … [Read more...] about Recovery of dues other than Government dues from the retirement benefits of BSNL VRS-2019 Scheme retired employees

BSNL – Payment of final instalment of Ex-Gratia in respect of retirees of BSNL VRS 2019 instructions

Payment of final instalment of Ex-Gratia in respect of retirees of BSNL VRS 2019 instructions thereof BHARAT SANCHAR NIGAM LIMITED(A Government of India Enterprise)CORPORATE OFFICE Establishment CellBharat Sanchar BhawanH.C. Mathur Lane, New Delhi-01 MOST URGENTTOP PRIORITY F.No: BSNLCO-A/ 11(11)/8/2020- ESTAB Dated: 12th January, 2021 To,All Heads of Telecom … [Read more...] about BSNL – Payment of final instalment of Ex-Gratia in respect of retirees of BSNL VRS 2019 instructions

Pension Revision for BSNL Pensioners/ Workers – Implementation of 3rd Pay Revision Committee recommendation W.E.F. Jan 01, 2017

BSNL Pensioners - 3rd Pay Revision Committee recommendation BSNL & DOT PENSIONERS ASSOCIATION (INDIA)CENTRAL HEAD QUARTER, AHMEDABAD - 380001 No: BDPA (I)/ 3rdPRC/ Pension Revision dated 17th December, 2020 To: Hon’ble Shri Narendrabhai Modi Ji,Hon’ble Prime Minister, Govt. of India,7 Race Course Road,New Delhi - 110 001 Re: Pension Revision for BSNL … [Read more...] about Pension Revision for BSNL Pensioners/ Workers – Implementation of 3rd Pay Revision Committee recommendation W.E.F. Jan 01, 2017

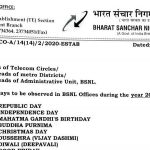

Holidays to be observed in BSNL Offices during the year 2021 – BSNL Holidays 2021

BSNL Holidays 2021 BHARAT SANCHAR NIGAM LIMITED(A Govt. of India Enterprise) File No. BSNLCO-A/14(14)/2/2020-ESTABDated:01.12.2020 To,Heads of Telecom Circles/All Heads of metro Districts/All Heads of Administrative Unit, BSNL. Subject: Holidays to be observed in BSNL Offices during the year 2021- reg. In accordance with Ministry of Personnel, Public Grievances … [Read more...] about Holidays to be observed in BSNL Offices during the year 2021 – BSNL Holidays 2021

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF