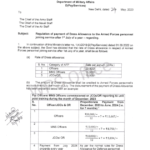

Armed Forces Dress Allowance Regulation of payment of Dress Allowance to the Armed Forces personnel joining service after 1st July of a year: MoD Order 24-05-2023 1(4)/2019/D (Pay/Services)Ministry of DefenceDepartment of Military AffairsD(Pay/Services) New Delhi, dated 24th May, 2023 To The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air … [Read more...] about Regulation of payment of Dress Allowance to the Armed Forces personnel joining service after 1st July of a year

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Armed Forces

7th CPC revised pension pre-2016 retired Medical Officers of Army Medical Corps/Army Dental Corps/Remount & Veterinary Corps

7th CPC revised pension pre-2016 ToThe Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air Staff Sub: Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission - Revision of pension of pre-2016 retired Medical Officers of Army Medical Corps/ Army Dental Corps/ Remount & Veterinary … [Read more...] about 7th CPC revised pension pre-2016 retired Medical Officers of Army Medical Corps/Army Dental Corps/Remount & Veterinary Corps

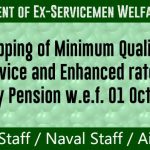

Minimum 7 years of continuous qualifying service is required for grant of enhanced rate of Family Pension for the Armed Forces personnel

F.No.14(02)/2019/ D(Pen/Pol)Government of IndiaMinistry of DefenceDepartment of Ex-Servicemen WelfareD(Pension/Policy) Room No.222, 'B' Wing,Sena Bhawan, New Delhi-110011.Dated: 5th October, 2020 To, The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air Staff Sub: Revision of Regulation relating to rate of Family Pension (Normal rate & … [Read more...] about Minimum 7 years of continuous qualifying service is required for grant of enhanced rate of Family Pension for the Armed Forces personnel

MoD: Modernisation of Armed Forces top priority, says Raksha Mantri Shri Rajnath Singh

PRESS INFORMATION BUREAU (DEFENCE WING) GOVERNMENT OF INDIA Modernisation of Armed Forces top priority, says Raksha Mantri Shri Rajnath Singh; Attends Golden Jubilee event of BDL in Hyderabad New Delhi: Sharavana 12, 1941 Saturday, August 3, 2019 Raksha Mantri Shri Rajnath Singh said modernisation of the Armed forces is the top priority of the government to enhance the … [Read more...] about MoD: Modernisation of Armed Forces top priority, says Raksha Mantri Shri Rajnath Singh

DEFENCE – Raksha Mantri Reviews Operational and Procurement Matters of Armed Forces

Ministry of DefenceRaksha Mantri Reviews Operational and Procurement Matters of Armed Forces 07 JUN 2019 Raksha Mantri Shri Rajnath Singh took a meeting of senior officers of Ministry of Defence to review operational matters and procurement issues of the Armed Forces. He discussed important revenue procurement cases regarding maintenance of platforms and assets with the … [Read more...] about DEFENCE – Raksha Mantri Reviews Operational and Procurement Matters of Armed Forces

DoPT – 26th Joint Civil Military (JCM) Training Programme on National Security from August 04 to 09, 2019

DoPT - 26th Joint Civil Military (JCM) Training Programme on National Security from August 04 to 09,2019 GOVERNMENT OF INDIADEPARTMENT OF PERSONNEL & TRAININGMINISTRY OF PERSONNEL, PUBLICGRIEVANCES AND PENSIONSNORTH BLOCK NEW DELHI -110001 D.O. No. 13017/4/2019-LTDP Dated: June 6, 2019 Dear Madam / Sir, The Lal Bahad ur Shastri National Academy of … [Read more...] about DoPT – 26th Joint Civil Military (JCM) Training Programme on National Security from August 04 to 09, 2019

MoD: Major activities of Department of Defence for the month of March, 2019

Major activities of Department of Defence for the month of March, 2019 Permanent Commission (PC) (1) Ministry of Defence has taken steps to ensure implementation of permanent commission to women in the Armed Forces. In so far the Indian Air Force is concerned, all branches, including Fighter Pilots, are now open for women officers. In Navy, all non-sea going … [Read more...] about MoD: Major activities of Department of Defence for the month of March, 2019

Media reports Malign GoI to the Armed Forces through NFFU / NFU

Media reports Malign GoI to the Armed Forces through NFFU / NFU Press Information Bureau Government of India Ministry of Defence 25-March-2019 Media Reports Maligning GoI over NFFU/NFU to Armed Forces Certain section of media is attempting to generate motivated controversy on the NFFU/NFU for Armed Forces while the case is still subjudice in the Apex Court. The … [Read more...] about Media reports Malign GoI to the Armed Forces through NFFU / NFU

Rent and Allied Charges in Respect of Indian Army Officers

Rent and Allied Charges in Respect of Indian Army Officers GOVERNMENT OF INDIA MINISTRY OF DEFENCEOFFICE OF THE PRINCIPAL CONTROLLER OF ACCOUNTS (FYS) PAY TECH SECTION No.Pay/Tech-I/Misc CIRCULAR.01 Dated:12/02/2019 To ALL Branch AOs Subject: Information regarding rent and allied charges in respect of Indian Army Officers A DO Letter has been revived from … [Read more...] about Rent and Allied Charges in Respect of Indian Army Officers

Defence – Modernisation of Armed Forces

Ministry of Defence Modernisation of Armed Forces 13 FEB 2019 Modernisation of the Armed Forces is a continuous process based on threat perception, operational challenges and technological changes to keep the Armed Forces in a state of readiness to meet the entire spectrum of security challenges. Government attaches the highest priority to ensure that the Armed Forces … [Read more...] about Defence – Modernisation of Armed Forces

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF