House Rent Allowance to Central Government employees - COMPENDIUM on Instructions by Department of Expenditure, Ministry of Finance. No.2/4/2022 -E.IIBGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New Delhi.Dated the 30th December, 2022. OFFICE MEMORANDUM Subject: Compendium of Instructions regarding grant of House Rent Allowance to … [Read more...] about HRA to Central Government employees COMPENDIUM on Instructions by FinMin

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

7th CPC HRA

Admissibility of HRA to Defence Service Personnel and Dispensation of the condition of furnishing No Accommodation Certificate of Armed Forces Personnel

Admissibility of HRA to Defence Personnel and Dispensation of condition of furnishing No Accommodation Certificate for Armed Forces Personnel Admissibility of House Rent Allowance (HRA) - Issue of Non Availability Certificate: PCDA(O) ADVISORY NO.: 34 Dated:- 01.06.2022 O/o PCDA(O) Pune, Public Relation office PRO Subject: Admissibility of House Rent Allowance … [Read more...] about Admissibility of HRA to Defence Service Personnel and Dispensation of the condition of furnishing No Accommodation Certificate of Armed Forces Personnel

Non Payment of enhanced HRA @ 9, 18 and 27 percent after DA increase beyond 25% – 7th CPC HRA with the salary of July 2021

7th CPC HRA After DA hike | 7th CPC HRA with the salary of July 2021 | HRA increase as per 7th CPC | HRA @ 9, 18 and 27 percent after DA increase beyond 25% | HRA for Central Government employees in 7th Pay Commission CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS1st Floor, North Avenue PO Building, New Delhi - 110001 Ref: Confd/HRA/2021 Dated - … [Read more...] about Non Payment of enhanced HRA @ 9, 18 and 27 percent after DA increase beyond 25% – 7th CPC HRA with the salary of July 2021

7th CPC HRA hike for Central Government employees and CPSE or PSU employees (3rd PRC) from 1st Jan 2021

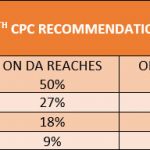

7th CPC HRA hike HRA will be hiked for 7th CPC Central Govt. employees and Armed Forces personnel, as DA crossed 25%, from 1st Jan 2021: Since 1st January 2021, the calculated Dearness Allowance is 28%. As per 7th CPC, there is a condition that HRA will be revised if DA crosses 25%. So, accordingly the HRA will be increased to 27 % / 18 % / 9 % from presently 24 % / 16 % … [Read more...] about 7th CPC HRA hike for Central Government employees and CPSE or PSU employees (3rd PRC) from 1st Jan 2021

Classification of Cities for HRA as per 7th CPC – X Y Z Classification of Cities for HRA 2020

Classification of Cities for HRA as per 7th CPC - X Y Z Classification of Cities for HRA 2020 No. 2/4/2018-E.II(B) Government of India Ministry of Finance Department of Expenditure Dated, the 25 February, 2020 North Block, New Delhi OFFICE MEMORANDUM Subject:- Re-classification of Mathura-Vrindavan Municipal Corporation as 'Y' class city for the purpose of grant of … [Read more...] about Classification of Cities for HRA as per 7th CPC – X Y Z Classification of Cities for HRA 2020

7th CPC HRA : Grant of House Rent Allowance to Central Government employees on basis of Census-2011

7th CPC HRA Grant of House Rent Allowance to Central Government employees on basis of Census-2011 2/5/2017-E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New Delhi Dated the 15th July, 2019 OFFICE MEMORANDUM Subject:- Re-classification / Upgradation of Cities / Towns on the basis of Census-2011 for the purpose of grant of … [Read more...] about 7th CPC HRA : Grant of House Rent Allowance to Central Government employees on basis of Census-2011

Grant of additional House Rent Allowance (HRA) to the civilian employees of the Central Government – Finmin Order

Grant of Additional House Rent Allowance to CG Employees - Finmin Order 14.8.2018 Grant of additional HRA to the civilian employees of the Central Government serving in the States of North Eastern Region, Andaman & Nicobar Islands, Lakshadweep Islands and Ladakh No.28/1/2017-E.II(B) Government of India Ministry of Finance Department of Expenditure New Delhi, dated the … [Read more...] about Grant of additional House Rent Allowance (HRA) to the civilian employees of the Central Government – Finmin Order

House Rent Allowance (HRA) : Report of the Committee on Allowances

House Rent Allowance (HRA) : Report of the Committee on Allowances House Rent Allowance (HRA) (Para 8.7.3-16) Existing Provisions: HRA is paid @30, 20 and 10 percent for X class (50 Lakh & above), Y class (5 to 50 lakh) and Z class (below 5 lakh) cities respectively. At present, in the case of those drawing either NPA or MSP or both, HRA is being paid as … [Read more...] about House Rent Allowance (HRA) : Report of the Committee on Allowances

Enhanced 7th CPC HRA benefit only 15 Slabs for lower levels

Enhanced HRA benefit only 15 Slabs for lower levels HRA is currently paid @ 30% for X (population of 50 lakh & above), 20% for Y (5 to 50 lakh) and 10% for Z (below 5 lakh) category of cities. 7th CPC has recommended reduction in the existing rates to 24% for X, 16% for Y and 8% for Z category of cities. As the HRA at the reduced rates may not be sufficient for … [Read more...] about Enhanced 7th CPC HRA benefit only 15 Slabs for lower levels

Cabinet Decision on 7th CPC HRA – Shocking News for Central government Employees

Cabinet Decision on 7th CPC HRA Shocking News for Central government Employees 7th CPC HRA is a big upset for Central Government Employees It is really a Shocking News for Central government Employees that 7th CPC HRA is not increased and retained the recommendation of 7th CPC on House rent Allowances with slight modifications. The date of effect of Allowances is another … [Read more...] about Cabinet Decision on 7th CPC HRA – Shocking News for Central government Employees

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF