6th CPC DA hike for Central Government employees from 1st July 2021 6th CPC DA - 164% to 189% of the Basic Pay with effect from 01.07.2021. No. 1/3(1)/2008 -E.1I(B)Government of India Ministry of FinanceDepartment of ExpenditureNorth Block, New DelhiDated the 13 August, 2021 OFFICE MEMORANDUM Subject- Revised rates of Dearness Allowance to the employees of … [Read more...] about Central Government employees DA as per 6th Pay Commission from July 2021 – 6th CPC DA hike DOE Order

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

6CPC

6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

Defence 6th CPC up-graded pay scales to the Fire Fighting Employees No.Pay/Tech-I/ 01(6th CPC), Cir No - 2 Dated 12/02/2020 TodThe All CFAs Subject: Grant of up-graded pay scales to the Fire Fighting staff in Ministry of Defence as per 6th CPC recommendation A copy of Government of India MoD letter No F. No.50266/6/PC/ EMECiv(C-2)178- F/D (O-II)2019, dated- … [Read more...] about 6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

Railway Nursing Cadre Initial pay fixation in 6th CPC pay structure

Railway Nursing Cadre Initial pay fixation in 6th CPC pay structure GOVERNMENT OF INDIA MINISTRY OF RAILWAYS (RAILWAY BOARD) PC-VI No. 402 RBE No. 09/2020 No. PC-VI/2009/1/6/5 New Delhi, dated: 30.01.202011.02.2020 The General Manager (P), All Indian Railways & Production Units (as per mailing list) Sub: Fixation of initial pay of Nursing Cadre in the … [Read more...] about Railway Nursing Cadre Initial pay fixation in 6th CPC pay structure

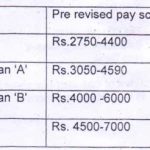

Rate of Dearness Allowance applicable w.e.f. 01.01.2019 to the Central Government Employees and Central Autonomous Bodies continuing to draw their pay in the pre revised pay scale/Grade Pay as per 6th CPC

6th CPC DA from Jan 2019 @154% for CGE and Central Autonomous Bodies continuing to draw pre-revised pay No. 1/3(1)/2008-E.II(B) Government of India Ministry of Finance Department of Expenditure North Block, New Delhi Dated the 8th March, 2019. OFFICE MEMORANDUM Subject:- Rate of Dearness Allowance applicable w.e.f. 01.01.2019 to the employees of Central … [Read more...] about Rate of Dearness Allowance applicable w.e.f. 01.01.2019 to the Central Government Employees and Central Autonomous Bodies continuing to draw their pay in the pre revised pay scale/Grade Pay as per 6th CPC

Rate of Dearness Allowance applicable w.e.f. 01.07.2018 to the employees of Central Government and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay as per 6th Central Pay Commission

Rate of Dearness Allowance applicable w.e.f. 01.07.2018 to the employees of Central Government and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay as per 6th Central Pay Commission No, 1/3/2008-E,II(B) Government of India Ministry of Finance Department of Expenditure New Delhi, dated the 11th September, 2018, OFFICE … [Read more...] about Rate of Dearness Allowance applicable w.e.f. 01.07.2018 to the employees of Central Government and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay as per 6th Central Pay Commission

6th Pay Commission Dearness Allowance ends with 6% hike at 125%

6th Pay Commission Dearness Allowance ends with 6% hike at 125% Cabinet approves 6 percent Dearness Allowance hike for Central Government employees “In the 7th Pay Commission report, submitted to the government on 19.11.2015, it was mentioned that the DA is assumed to be 125 percent as on 1 January, 2016, the day from which the Commission expects its recommendations to … [Read more...] about 6th Pay Commission Dearness Allowance ends with 6% hike at 125%

Payment of revised rate of Composite Personal Maintenance Allowance (CPMA) as per 6th CPC Orders

Payment of revised rate of Composite Personal Maintenance Allowance (CPMA) as per 6th CPC Orders Ministry Of Defence D(pay/Services) Subject: Payment of revised rate of Composite Personal Maintenance Allowance (CPMA) as per 6th CPC Orders. Reference CGDA UO No.AT/I/3510/6th CPC/Vol. IX dated 21.01.2015 on the above subject. 2. The matter has been examined in … [Read more...] about Payment of revised rate of Composite Personal Maintenance Allowance (CPMA) as per 6th CPC Orders

Finance Minister Arun Jaitley to receive Sixth Pay Commission report in December

New Delhi,: The Seventh Pay Commission headed by Justice Ashok Kumar Mathur is likely to submit its report to Union Finance Minister Arun Jaitley in December, presumably recommending a 40 per cent hike in salary for the central government employees. Justice Mathur already told PTI on August 25, “The Commission may submit its report by the end of September.” “We are likely … [Read more...] about Finance Minister Arun Jaitley to receive Sixth Pay Commission report in December

Revision of House Rent Allowance for CPSE employees on the basis of Census – 2011

Revision of House Rent Allowance for CPSE employees on the basis of Census – 2011 No. 2(46)/2012-DPE (WC)-GL-XIII /2015 Government of India Ministry of Heavy Industries & Public Enterprises Department of Public Enterprises Public Enterprises Bhawan, Block No.14, CGO Complex, Lodhi Road, New Delhi. Dated, the 07th Sept 2015 OFFICE MEMORANDUM Subject : … [Read more...] about Revision of House Rent Allowance for CPSE employees on the basis of Census – 2011

Release of additional instalment of Dearness Allowance to Central Government employees and Dearness Relief to Pensioners due from 1.7.2015

Release of additional instalment of Dearness Allowance to Central Government employees and Dearness Relief to Pensioners due from 1.7.2015 The Union Cabinet, chaired by the Prime Minister Shri Narendra Modi, has approved release of an additional instalment of Dearness Allowance (DA) to Central Government employees and Dearness Relief (DR) to Pensioners w.e.f. 01.07.2015. This … [Read more...] about Release of additional instalment of Dearness Allowance to Central Government employees and Dearness Relief to Pensioners due from 1.7.2015

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF